If your business is any more complex than that, most accountants will strongly recommend switching to double-entry accounting. Accountants call this the accounting equation, and it’s the foundation of double-entry accounting. If at any point this equation is out of balance, that means the bookkeeper has made a mistake somewhere along the way. It is not possible to keep accounts in this manner for those who do not have a thorough understanding of accounting principles.

“It was just a whole revolution in the way of thinking about business and trade,” writes Jane Gleeson-White of the popularization of double-entry accounting in her book Double Entry. Recording transactions this way provides you with a detailed, comprehensive view of your financials—one that you couldn’t get using simpler systems like single-entry. In this article, we’ll explain double-entry accounting as simply as we can, how it differs from single-entry, and why any of this matters for your business. However, in many cases, determining which party will be debited and which party will be credited becomes complicated. As a result, storing different books according to account classification will increase the workload of the business organization.

To account for this transaction, $5,000 is entered into the insurance account as a debit. This account will eventually be a charge in the profit and loss account. Double-entry provides a more complete, three-dimensional view of your finances than the single-entry method ever could. When you send an invoice to a client after finishing a project, you would “debit” accounts receivable and “credit” the sales account. Noting these flaws, a group of accountants—in 12th century Genoa, 13th century Venice, or 11th century Korea, depending on who you ask—came up with a new kind of system called double-entry accounting.

Double-entry bookkeeping

- Each entry has a “debit” side and a “credit” side, recorded in the general ledger.

- Liabilities represent everything the company owes to someone else, such as short-term accounts payable owed to suppliers or long-term notes payable owed to a bank.

- For each credit entered into a ledger there must also be a corresponding (and equal) debit.

- It’s quick and easy—and that’s pretty much where the benefits of single-entry end.

Nowadays, the double-entry system of accounting is used all over the world. This is because it is the only reliable system for recording business transactions. Single-entry accounting involves writing down all of your business’s transactions (revenues, expenses, payroll, etc.) in a single ledger. If you’re a freelancer or sole proprietor, how to prepare a post closing trial balance you might already be using this system right now. It’s quick and easy—and that’s pretty much where the benefits of single-entry end. For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount.

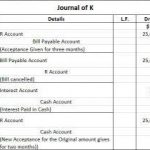

Example 1: Business Purchases Using Credit

One of the characteristics of a double-entry system is that each transaction must involve two parties. The Double Entry System is well-established and well-known throughout the world as a dependable, scientific, and comprehensive system for keeping business accounts. A bakery purchases a fleet of refrigerated delivery trucks on credit; the total credit purchase was $250,000. The new set of trucks will be used in business operations and will not be sold for at least 10 years—their estimated useful life. This content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

Debit on the left, credit on the right

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding how to claim cca on a business vehicle sides, known as debit and credit; this is based on the fundamental accounting principle that for every debit, there must be an equal and opposite credit.

It follows that the bookkeeping system must always balance, which is a big advantage. Some types of mistakes will cause the system to be out of balance; as a result, the bookkeeper will be alerted to a problem. The double-entry system of accounting was first introduced by an Italian mathematician, Fra Luca Pacioli, in 1544 in Venice. Pacioli’s treatise describing the double-entry system was entitled De Computis et Scripturis.

As a result, the same amount has been debited for both the rent and the cash account. If the bakery’s purchase was made with cash, a credit would be made to cash and a debit to asset, still resulting in a balance. In accounting, debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger. With a double-entry system, credits are offset by debits in a how to calculate markup general ledger or T-account. A sub-ledger may be kept for each individual account, which will only represent one-half of the entry. The general ledger, however, has the record for both halves of the entry.

What Is the Disadvantage of the Double-Entry Accounting System?

When a company borrows funds from a creditor, the cash balance increases and the balance of the company’s debt increases by the same amount. Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business. You invested $15,000 of your personal money to start your catering business. When you deposit $15,000 into your checking account, your cash increases by $15,000, and your equity increases by $15,000. When you receive the money, your cash increases by $9,500, and your loan liability increases by $9,500.

Betty Wainstock

Sócia-diretora da Ideia Consumer Insights. Pós-doutorado em Comunicação e Cultura pela UFRJ, PHD em Psicologia pela PUC. Temas: Tecnologias, Comunicação e Subjetividade. Graduada em Psicologia pela UFRJ. Especializada em Planejamento de Estudos de Mercado e Geração de Insights de Comunicação.