Perpetual inventory systems are also known as continuous inventory systems because they sequentially track every movement of inventory. The example above shows how a perpetual inventory system works when applying the FIFO method. The ending inventory at the end of the fourth day is $92 based on the FIFO method. On 2 January, Bill launched his web store and sold 4 toasters on the very first day. On 1 January, Bill placed his first order to purchase 10 toasters from a wholesaler at the cost of $5 each. Bill sells a specific model of a toaster on his website for $12 apiece.

Advantages & Disadvantages of Using the FIFO Method

Now, let’s assume that the store becomes more confident in the popularity of these shirts from the sales at other stores and decides, right before its grand opening, to purchase an additional 50 shirts. The price on those shirts has increased to $6 per shirt, creating another $300 of inventory for the additional 50 shirts. This brings the total of shirts to 150 and total inventory cost to $800. The FIFO method can result in higher income taxes for a company because there’s a wider gap between costs and revenue.

Step 3: Calculate COGS

For brands looking to store inventory and fulfill orders within their own warehouses, ShipBob’s warehouse management system (WMS) can provide better visibility and organization. With this level of visibility, you can optimize inventory levels to keep carrying costs at a minimum while avoiding stockouts. ShipBob’s ecommerce fulfillment solutions are designed to make inventory management easier for fast-growing DTC and B2B brands. Additionally, it ensures that you are more likely to use the actual price you paid for the goods in your income statements, making the calculations more accurate and simple, and record-keeping much easier.

Is FIFO applicable to all businesses?

This is because she presumes that she sold the 80 units that she bought for $3 apiece first. Susan started out the accounting period with 80 boxes of vegan pumpkin dog treats, which she had acquired for $3 each. Later, she buys 150 more boxes at a cost of $4 each, since her supplier’s price went up. For example, say your brand acquired your first 20 units of inventory for $4 apiece, totaling $80. Later on, you purchase another 80 units – but by then, the price per unit has risen to $6, so you pay $480 to acquire the second batch. First, we add the number of inventory units purchased in the left column along with its unit cost.

Business

The next shipment to sell would be the July lot under FIFO – since it is not the oldest once the June items are sold – leaving you with $2,000 profit. There are three other valuation methods that small businesses typically use. Many businesses use FIFO, but it’s especially important for companies that sell perishable goods or goods that are subject to declining value. This includes food production companies as well as companies like clothing retailers or technology product retailers whose inventory value depends upon trends. It can be easy to lose track of inventory, so adopt a practice of recording each order the day it arrives.

Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Consider the following practices to ensure your FIFO calculations are accurate and up to date. You omnichannel fulfillment partner that’s an extension of your brand, from unboxings to 2-day shipping. FIFO is also the option you want to choose if you wish to avoid having your books placed under scrutiny by the IRS (tax authorities), or if you are running a business outside of the US. Inventory is valued at cost unless it is likely to be sold for a lower amount. On the other hand, Periodic inventory systems are used to reverse engineer the value of ending inventory.

- If your inventory costs don’t really change, choosing a method of inventory valuation won’t seem important.

- To find the cost valuation of ending inventory, we need to track the cost of inventory received and assign that cost to the correct issue of inventory according to the FIFO assumption.

- FIFO takes into account inflation; if prices went up during your financial year, FIFO assumes you sold the cheaper ones first, which can lead to lower expenses and higher reported profit.

- If suppliers or manufacturers suddenly raise the price of raw materials or goods, a business may find significant discrepancies between their recorded vs. actual costs and profits.

- It can be easy to lose track of inventory, so adopt a practice of recording each order the day it arrives.

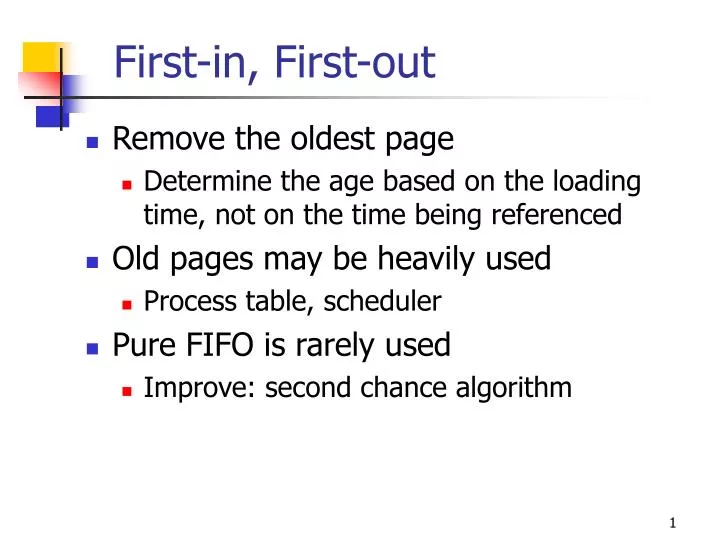

In the FIFO method, your cost flow assumptions align with how the business actually operated in a given period. FIFO, or First In, Fast Out, is a common inventory valuation business process flowchart symbols method that assumes the products purchased first are the first ones sold. This calculation method typically results in a higher net income being recorded for the business.

For example, say that a trampoline company purchases 100 trampolines from a supplier for $40 apiece, and later purchases a second batch of 150 trampolines for $50 apiece. Read on for a deeper dive on how FIFO works, how to calculate it, some examples, and additional information on how to choose the right inventory valuation strategy for your business. Though some products are more vulnerable to fluctuating price changes, dealing with inflation when restocking inventory is inevitable.

Betty Wainstock

Sócia-diretora da Ideia Consumer Insights. Pós-doutorado em Comunicação e Cultura pela UFRJ, PHD em Psicologia pela PUC. Temas: Tecnologias, Comunicação e Subjetividade. Graduada em Psicologia pela UFRJ. Especializada em Planejamento de Estudos de Mercado e Geração de Insights de Comunicação.