It disregards anomalies or external factors, focusing only on the core business functions. While revenue signals potential profitability, COGS is the pinch that reminds businesses of the cost of doing business. The purpose of a P&L statement is to provide information about a company’s overall ability to generate profit, either by increasing revenue or decreasing costs, or both. In financial risk management, the function is mapped to a monetary loss. Still different estimators would be optimal under other, less common circumstances.

Capital and Revenue Losses FAQs

This format is the go-to for larger corporations and those keen on presenting a detailed picture to stakeholders. It sheds light on operational efficiency while also capturing the impact of peripheral activities. The single-step P&L Statement operates on this principle, collating all revenues and subtracting all expenses in one clean sweep. It’s the bottom line, the figure most stakeholders dart their eyes towards.

- A company’s P&L statement shows its income, expenditures, and profitability over a period of time.

- Regulatory bodies have the power to issue substantial penalties for non-compliance.

- Unlike impairment of an asset, impaired capital can naturally reverse when the company’s total capital increases back above the par value of its capital stock.

- Because revenues and expenses are matched during a set time, a net loss is an example of the matching principle, which is an integral part of the accrual accounting method.

- Please note that some information might still be retained by your browser as it’s required for the site to function.

Understanding Impairment

Businesses may also face fines for late or incorrect filings, even if the mistake was unintentional. Furthermore, the reputational damage caused by non-compliance can result in significant lost sales, further contributing to financial loss. As such, understanding and navigating the regulatory environment is a key part of minimizing potential financial loss. Although each of these loss mitigation strategies comes with its own set of benefits, they are most effective when combined.

What is your risk tolerance?

Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. A debit entry is made to “Loss from Impairment,” which will appear on the income statement as a reduction of net income, in the amount of $50,000 ($150,000 book value – $100,000 calculated fair value). An impaired capital event occurs when a company’s total capital becomes less than the par value of the company’s capital stock.

What is the purpose of a Profit and Loss Statement?

If any impairment exists, the accountant writes off the difference between the fair value and the carrying value. When evaluating a profit and loss statement, it is important to consider statements from previous periods to get a more accurate sense of the rate of change in a company’s revenues and expenses. For example, if a company’s expenses are increasing faster than its revenue over several fiscal years, it could indicate a looming problem. Capital periodic inventory system definition losses occur when assets held as an investment or for production purposes, such as land or manufacturing equipment, are sold for less than your value in the asset, according to the IRS. Your value in the asset is how much you spent to acquire it, minus any depreciation you might have claimed based on using the asset over the years. Net loss occurs when all sources of income are less than the total of all expenses and losses from disposing assets.

A loss will also be recorded if a company is ordered by a judge to pay to settle a lawsuit, or if it loses money on a financial investment. Say that substantial refunds were expected as companies took advantage of outstanding tax credits previously issued as a way of retaining jobs in the state during the recession. As a result, the state treasurer anticipates a decrease of $99 million in revenue from the state’s principal business taxes. This prompts state officials to cut the current and upcoming fiscal year revenue projections by a significant amount and, unless they can cut expenditures as well, they will be operating at a net loss. The cash method, which is also called the cash accounting method, is only used when cash goes in and out of the business.

Maintaining a balance sheet that shows profitability is key to retaining investor confidence and thus protecting shareholder value. Shareholder voting power isn’t directly proportionate to a company’s profitability. Companies suffering from substantial financial losses may issue new shares to raise capital which can result in the dilution of existing shareholders’ voting power.

A loss is an excess of expenses over revenues, either for a single business transaction or in reference to the sum of all transactions for an accounting period. The presence of a loss for an accounting period is closely watched by investors and creditors, since it can signal a decline in the creditworthiness of a business. A loss occurs anytime a business sells an asset for less than the amount the business spent to obtain this asset. An operating loss occurs when the revenue derived from selling your business’ products is less than the expenses incurred to make them.

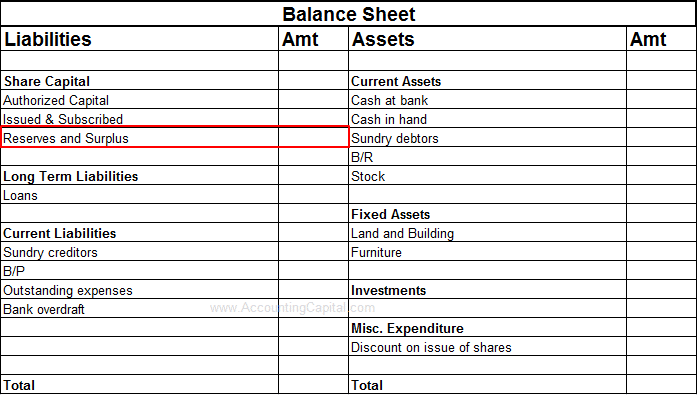

The P&L or income statement, like the cash flow statement, shows changes in accounts over a set period of time. The balance sheet, on the other hand, is a snapshot, showing what the company owns and owes at a single moment. It is important to compare the income statement with the cash flow statement since, under the accrual method of accounting, a company can log revenues and expenses before cash changes hands.

Betty Wainstock

Sócia-diretora da Ideia Consumer Insights. Pós-doutorado em Comunicação e Cultura pela UFRJ, PHD em Psicologia pela PUC. Temas: Tecnologias, Comunicação e Subjetividade. Graduada em Psicologia pela UFRJ. Especializada em Planejamento de Estudos de Mercado e Geração de Insights de Comunicação.